How you LIVE tomorrow, depends on how you INVEST today

Investment Services

Building an investment portfolio designed to address your unique long-term goals and financial dreams is a complex process that requires knowledge, skill, dedication and expertise. For investors in today’s ever-changing financial markets, a professional financial advisor can provide knowledgeable advice to help you pursue your financial goals.

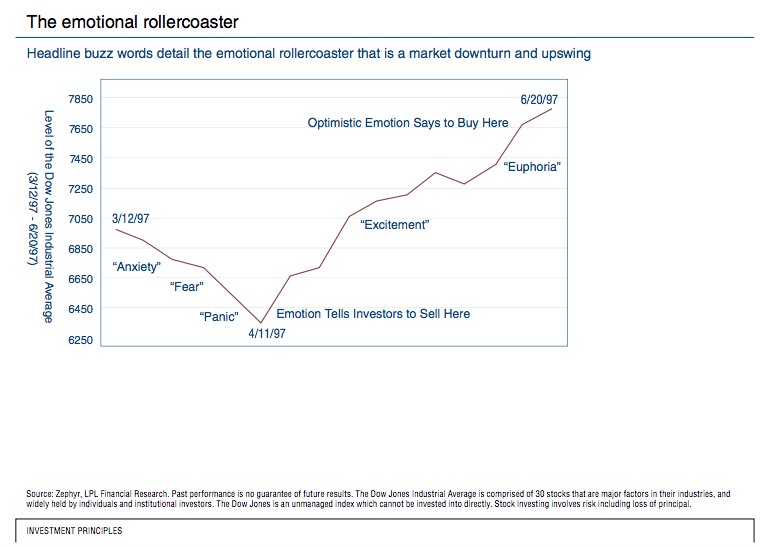

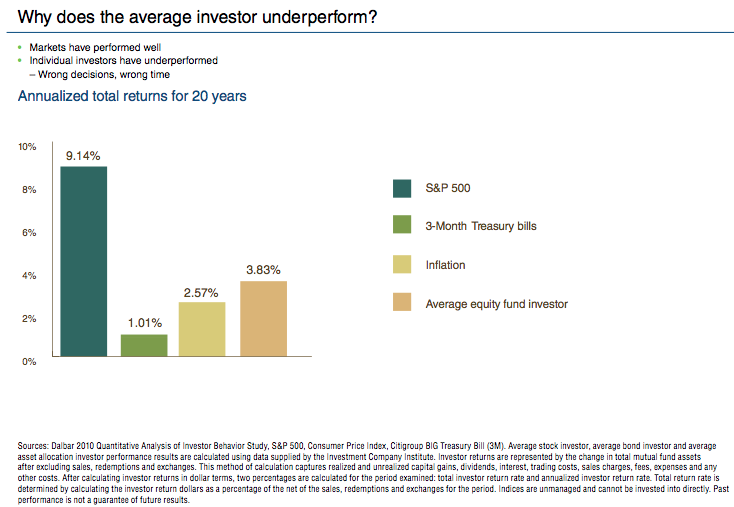

Investors face many challenges in today’s dynamic markets. Investing can be a very emotional experience and these emotions and other factors typically result in the average investor underperforming the markets due to poor decisions and poor timing.

Here are a few of the challenges facing the average investor:

Not having a clearly defined investment objective:

Whether building a new house or an investment portfolio, you first need to establish a solid foundation. Gaining an in-depth understanding of your unique financial goals is key to this process.

Improperly judging risk:

In general, the longer the time horizon of your investments, the more risk you can take on. Many investors, fearing even a little amount of risk, focus only on investments that address short-term volatility even though their time horizon may be 20 years or more. The result is a poorly performing portfolio in relation to their investing goals and time horizon.

Being led by your emotions:

Every day you hear new theories or speculation about the direction of the stock market from the media, friends, family and coworkers. It can be challenging to sort through differing opinions, filter out the noise and stay focused on your long-term investing goals. Many investors find themselves preoccupied with the fear of investment losses and mistakenly make costly investment decisions.

Being overconfident in a single stock or sector:

Relying solely on your intuition or creating attachments to specific stocks or sectors without reading impartial analyses and reports can lead to poor investing decisions.

Not investing globally:

A well-diversified portfolio should include assets with low correlation to each other. Some American investors may tend to lean toward domestic securities and avoid global investing opportunities altogether. By investing only in U.S. stocks, you could miss out when foreign stocks perform well.

Paying too much in taxes:

Structuring your investments properly by mitigating the effect of taxes on your portfolio can help preserve and ultimately build more of your investments over time. Not using tax-efficient money managers or strategies where appropriate may cause you to pay taxes unnecessarily.

Not understanding the costs:

Understanding and minimizing portfolio expenses can help enhance net returns and have a significant impact on the long term growth of your investments. Many investors are oblivious to the various costs associated with many investments. Typical expenses may include: transaction costs, administrative fees, sales loads, management fees, advisory fees, surrender charges and other miscellaneous fees. It is important to understand the cost structure of each investment. While there is always a cost to investing, some costs can be reduced or avoided entirely.

Certain risks are inherent in investing, as with any endeavor. The process of asset allocation — how money is spread across different asset classes, such as domestic and international equity, domestic and international fixed income and cash alternatives — provides a disciplined approach to assembling portfolios. The goal of asset allocation is to create portfolios that offer the highest potential return for an acceptable level of risk. By constructing a blended and diversified portfolio of asset classes, individual asset class performance in different market cycles does not move in unison and investors are better positioned to weather volatility.

Academic studies have shown that asset allocation is the major factor in the variability of a portfolio’s return. Other factors, including security selection and market timing, typically account for a smaller percentage. Brinson, Singer & Beebower’s study, “Determinants of Portfolio Performance II: An Update,” found that on average, asset allocation decisions explained more than 90% of the variation of portfolio returns.

Following are various Investment Services that we make available to assist in pursuing a sound investment strategy and implementation.

Assessment of current investment plan, managers and overall asset allocation

Assessment of Retirement Plan Asset Allocation

Cost Analysis & Cost Reduction Strategies

Goals & Objectives Planning Meetings

Development of Investment Strategies

Economic and Market Reviews

Manager & Investment Analysis and Selection

Access to a Variety of Non-Proprietary Investments

Stocks, ETFs & Bonds

Institutional Managers

Mutual Funds

Structured Notes

UITs

Direct and Alternative Investments

Variable and Fixed Annuities

Fee Based and Transactional Services

Development of Investment Policy Statements

Tax Planning

Income & Cash Flow Management

Ongoing Investment Management

Quarterly, Semi-Annual and Annual Investment Reviews

Weekly Economic and Market Commentary

Daily Updated On-line View of Assets

Contact us today for more information regarding our investment services.

DISCLOSURES

* Above charts are for illustrative purposes only. Due to fluctuating market conditions, current values presented will have changed.

** International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

*** Investing involves risk including loss of principal. No strategy, including asset allocation, assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.